One of every three German manufacturers is thinking about relocating abroad amid the bloc’s economic difficulties, twice the number of 2022, Bild media sources reported Saturday, noted Siegfried Russwurm, the chief of the Alliance of German Enterprises (BDI).

The outlet reported that among the most recent firms wanting to migrate is domestic device producer Miele, which intends to eliminate 2,000 positions in Germany and move 700 employees to its site in Poland. the heating systems maker Viessmann had previously moved 3,000 positions to Poland.

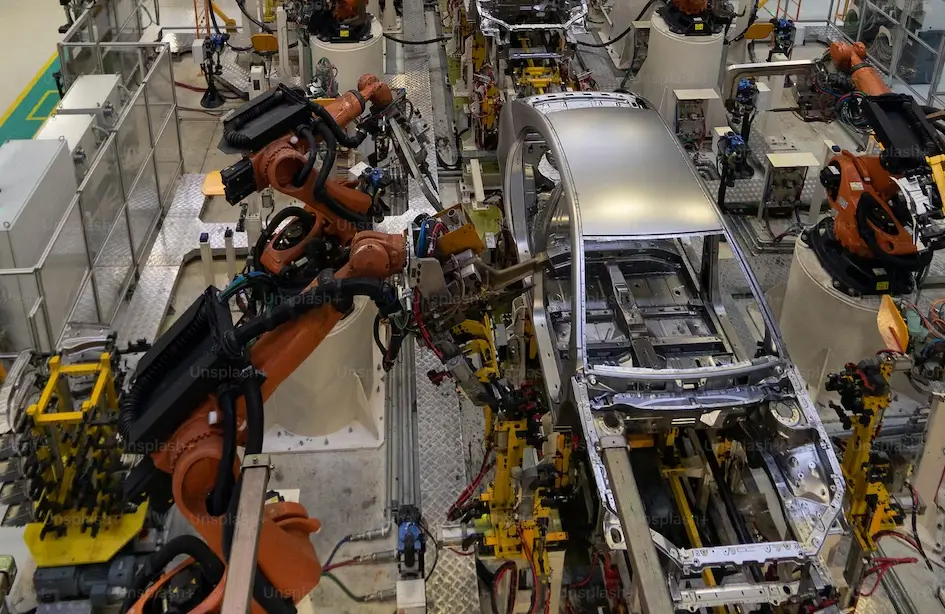

Volkswagen said last year that it would create another battery production line in the US, and BASF reported plans to put €10 billion in a petrochemicals plant in China in the midst of making cuts at its central headquarters in Germany. French steel pipe producer Vallourec shut down manufacturing in Germany in September last year, while tiremaker Michelin and its US rival Goodyear said they would likewise close their German plants toward the end of 2025.

Russwurm says that an increasing number of organizations have revealed that their “patience with Germany is at an end.” He claims that Berlin lacks a plan to improve the situation and that investment has decreased as a result of the economic slowdown and high inflation rates, particularly in the energy sector. This has led to a continuous decrease in manufacturing, he expressed, and while current manufacturing lines might keep on working for some time, “new ones are no longer being built in Germany.”

After Germany lost access to Russian natural gas in 2022, many businesses found the skyrocketing energy costs became one of the main reasons for their difficulties. This was exacerbated by Berlin’s decision to switch from coal and nuclear energy to renewables. According to Russwurm, this put German manufacturers at a significant disadvantage to those in other industrialized nations.

“Nobody can say with any certainty today what our energy supply will look like in seven years’ time, and that’s why no one can say how high energy prices will be in Germany then. For companies that have to make investment decisions, that is absolutely toxic,” he said in a meeting with the Financial Times recently, adding that the public authority is making things worse in regards to its energy strategy with its aggressive environmental plans, which seeks to attain carbon neutrality by 2045 with 80% of its energy coming from solar and wind power by 2030.

Russwurm said, “Companies are saying they are finding it increasingly difficult to do any long-term planning. They have great doubts about continuing to invest in Germany under these conditions. The conditions are better elsewhere. And they’re going abroad.”