The deputy governor for monetary stability of the Bank of Thailand, Alisara Mahasantana, has come out and said that the regulator fully supports the use of local currencies for settlement of international trade obligations

The deputy governor said that the risks caused by the fluctuations in the US dollar, which have recently been as high as 8-9%, should be minimized through the use of local currencies.

The official said the primary objective of such a move would be to offer an alternative means by which Thai businesses would be able to pay for goods and services.

She went on to say, “During periods of significant dollar volatility, business operators can opt to use these local currencies for payments instead. This reduces the risk associated with exchange rates, making trade negotiations easier.”

Indonesia, Malaysia, and Thailand have already signed a three-way agreement promising to promote the use of local currencies in bilateral trade deals. A joint statement released by the central banks of all three nations noted that the objective of the deal was to increase trade by offering an accessible and efficient means of local currency settlements.

Earlier in the year, it was reported that the Association of Southeast Asian Nations (ASEAN) was planning to hold discussions focused on dropping the US dollar, euro, yen, and pound sterling as methods of cross-border trade settlement, and transitioning to the usage of local currencies in settlements.

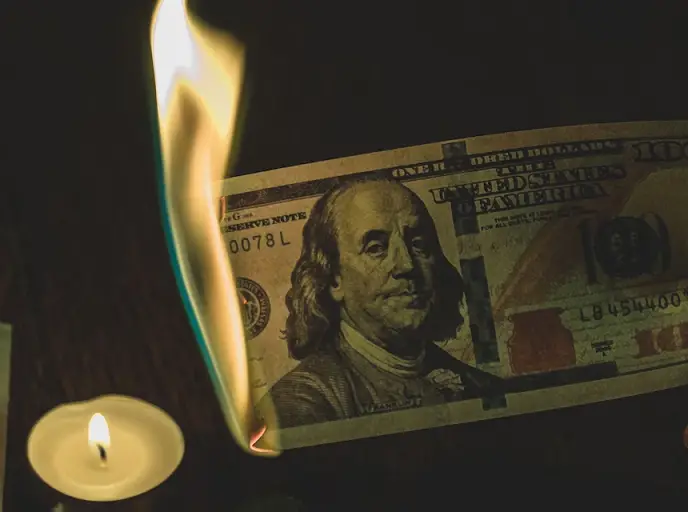

The moves are part of a growing global trend to move away from the US dollar and the euro as methods of trade settlement.

The move has been attributed to the recent use by Western nations of access to Western financial mechanisms of trade settlement as a means of coercion against other nations. Following the Russian invasion of Ukraine, the West has imposed a raft of sanctions on Moscow designed to hurt the nation economically by locking it out of the Western financial mechanisms for settling trade obligations.

However Russia, which is one of the main producers and exporters of energy, began offering its energy products at a discount, in a market which had been tightened by the sanctions, and where prices were skyrocketing.

This incentivized other nations to find alternative means of settlement for use with Russia, as still other nations looked to secure alternative means of settlement for their own international trade, so that their economies would not be at the mercy of Western powers, on whose financial mechanisms, the countries had become dependent on.

This has triggered a wave of de-dollarization strategies across a broad swath of nations and trade groups.