One of Russia’s top bankers said Thursday that one of the topics on the agenda for the ongoing Russia-Africa summit will be the use of alternative payment mechanisms in mutual trade.

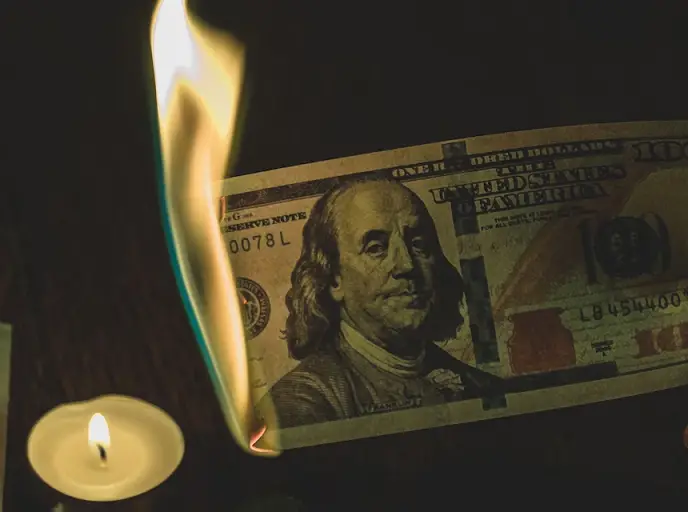

Speaking on the sidelines of the event in St Petersburg, the CEO of VTB, the largest bank in Russia, Andrey Kostin, said that the recent political weaponization of the dollar will inevitably force other nations to move away from its use as a reserve currency in global trade.

Kostin said, “Structural changes are bound to happen. African countries are also acting on this. They have already started to create their own systems of information exchange and settlements in national currencies. This is a promising trend.”

He concluded, “A share of trade settlements in alternative currencies will continue to increase.”

Following Russia’s nearly complete blockade from the use of Western financial systems by economic sanctions levied against Moscow over the military action in Ukraine, Russia and its partners in global trade, particularly its fellow members of the BRICS alliance, Brazil, India, China, and South Africa, have begun to switch to the use of alternative currencies in mutual trade. As this has happened, a growing number of other nations have come to fear relying on the use of the dollar and access to Western financial systems, as they could be used politically to pressure their governments As a result they have increasingly supported the move to use alternative currencies, a trend referred to as “de-dollarization.”

Earlier this month, Russian President Vladimir Putin revealed that more than 80% of Russia-China trade is now being settled in rubles and yuan.

At the beginning of July, Russia announced it was also planning to open discussions to switch to national currencies with the countries of the Association of Southeast Asian Nations (ASEAN), specifically, Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.