On Monday, global crude prices stabilized following the resolution of a possible armed insurrection by the Wagner private military company against the Russian government, which is among the top energy exporters in the world.

Brent crude futures rose almost 0.72% to $74.38 per barrel as of 07:25 GMT. US benchmark West Texas intermediate rose 0.65% to $69.61. Both benchmarks were up by as much as 1.3% in early Asian trading.

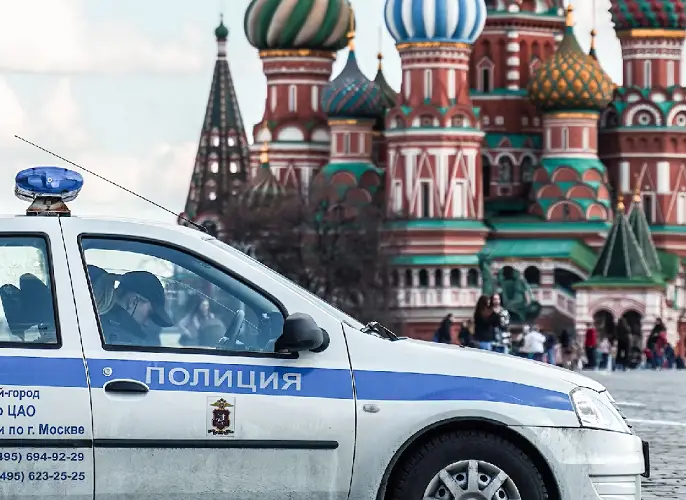

The rebellion by the Wagner group began Friday, when leader Evgeny Prigozhin seized an army headquarters in the Russian city of Rostov-on-Don, and some Wagner forces began a public march toward Moscow. However after negotiations mediated by Belarusian President Alexander Lukashenko, and the issuance of “security guarantees” to Wagner fighters, Prigozhin agreed to end the rebellion and withdraw his forces on Saturday.

Given Russia is one of the biggest energy producers and exporters in the world, the markets watched events closely with an eye to any potential disruptions to global energy supplies.

In an interview with CNBC, Alok Sinha, Standard Chartered global head of oil, gas and chemicals, said, “Collectively the world would have breathed a sigh of relief at least on the oil market side that the disruption in the Russian state did not go through the worst that people feared.”

He added that had the rebellion led to a disruption in Russia’s output, it could have temporarily removed up to 4 million barrels of oil per day from the market.

He emphasized, “Now that kind of disruption even if it’s short term could have really roiled the markets really badly.”