According to preliminary figures released by the Taiwanese Directorate General of Budget Accounting and Statistics on Friday, in the first quarter of 2023, Taiwan’s economy, dependent on lagging exports, slipped into a recession.

Gross Domestic Product appears to have slipped by 3.02% in the first quarter compared to a year earlier, according to the office. In the fourth quarter of last year GDP had fallen 0.41% year over year.

The data shows that despite the fact that Taiwan is now reopened for business and travel following the Covid-19 pandemic, the global economic slowdown, and the sluggish demand for technology products it has produced, continues to weigh down the nation’s economy. The first quarter preliminary forecast was worse than the initial forecast for a 1.20% contraction, and the prediction from a Reuters poll of economists which had predicted a 1.25% contraction.

The statistics office noted that the pressure of global inflation, interest rate hikes, weak demand, and the effects of inventory adjustments across the supply chains all heavily affect export volumes. The exports of goods and services in Taiwan contracted 10.86%.

The government had previously predicted full year growth to come in at 2.12% in 2023. That reading would mark the most sluggish growth rate seen in almost eight years, and below the 2.45% growth seen in 2022.

All border restrictions the government had imposed on foreign travelers during the Covid-19 pandemic have been lifted in recent months. Even the requirement to wear a facemask on public transportation has been lifted.

One bright spot in the data is private consumption, which had grown by 6.60% in the first quarter. The office noted, “With the weakening of the pandemic, traveling, shopping and dining have returned significantly. In the first quarter, the turnover of the retail industry and the catering industry increased by 5.28% and 17.18%, respectively, compared with the same quarter of the previous year.”

However, for such an export-based economy, consumption and travel may not be sufficient to offset weak international demand for technology products.

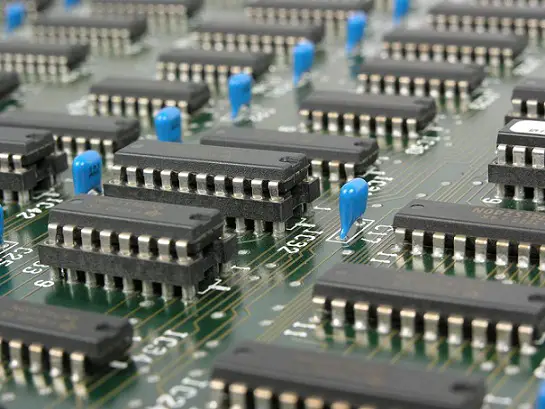

Taiwan is home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co. (TSMC), and acts as a critical hub in the international supply chain for technology companies such as Apple.

Nick Marro, an analyst with the Economist Intelligence Unit said, “Weak external demand remains the biggest challenge for Taiwan, with China’s reopening having failed to lift demand for Taiwanese goods like chips and other critical intermediate components.”

Taiwan’s exports are also being hit by higher levels of customer inventory in the US and Europe, he noted, adding, “The most optimistic forecasts aren’t expecting a rebound in Taiwanese export activity until the second half of 2023, but even that could be an optimistic timeline.”