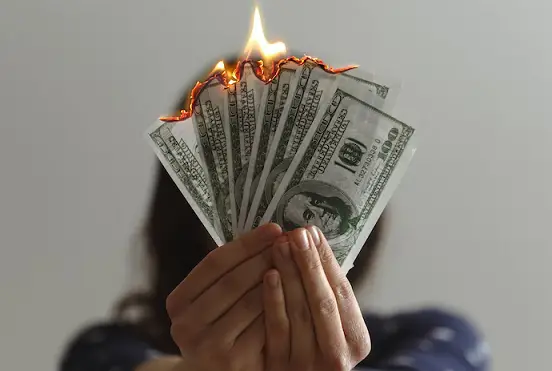

American household spending is increasing due to soaring inflation in the country, according to a report by CNBC this week. According to the data, households are spending an additional $433 more per month this year, for the exact same goods and services, compared to last year.

US consumer prices were up 7.7% on the year last month. While it was nowhere near the 9.1% that prices rose in June, it was still close to a 40-year high. The food that people buy at school and at work has almost doubled in price, just since October of last year. Eggs and butter were up over 33%, as milk, poultry, and bread all cost 15% more. Gasoline rose by 17.5%, and transportation costs were up by 28%.

Meanwhile Moody’s is reporting that inflation is rapidly outstripping wages, leaving the average worker with less purchasing power. Hourly wages are down by 2.8%, according to the report.

In summary, Bernard Yaros, an economist at Moody’s, said, “Despite weaker-than-expected inflation in October, households are still feeling the squeeze from rising consumer prices.”

Yaros noted inflation is hitting different groups differently, adding, “younger and rural Americans, as well as those without a bachelor’s degree,” have been hit the hardest.

Financial advisors are recommending households change their buying habits, such as by traveling to destinations closer to your home, seeking discounts, buying in bulk, and shopping with a strictly formulated list of solely necessities.

Joseph Bert, the CEO of Certified Financial Group said, “There’s no one silver bullet… It’s all those little decisions that add up at the end of the month.”