Following its latest policy meeting the Federal Reserve announced its third consecutive 75 basis point interest rate hike, as it continues to battle with a stubbornly persistent inflation. The third 75 basis point hike was unprecedented in the history of the Federal Reserve’s use of the fed funds rate to conduct monetary policy, which goes back to the 1980’s.

This meeting saw the Fed’s benchmark interest rate, the federal funds rate, go from 2.25% to 2.5%, up to 3.0%-3.25%, the highest level seen since the financial crisis of 2008.

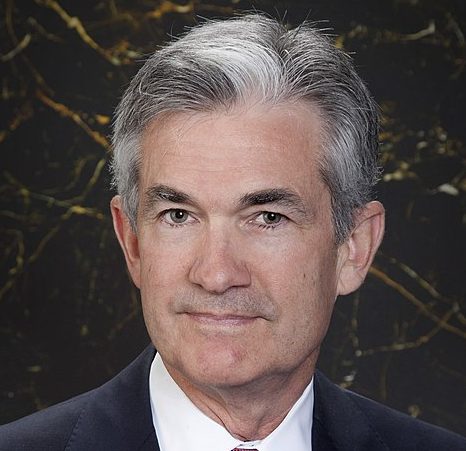

Stocks initially fell on the news, gained back some of the losses as Fed Chair Jerome Powell read prepared remarks, and then stocks dropped to new lows following the press conference’s conclusion.

At the press conference, Powell emphasized that, “my colleagues and I are strongly committed to bringing inflation back down to our 2% goal.” He noted the economy was still quite resilient, with, “modest growth in spending and production,” compared with their assessment in July when he noted they saw signs of softening.

He also reiterated that, “we are focused on… getting inflation back down to 2%. We can’t fail to do that. I mean, if we were to fail to do that, that would be the thing that would be most painful for the people that we serve. So, for now, that has to be our overarching focus.”

The latest hike comes as inflation has continued to come in over expectations and predictions continue to see it elevated throughout the rest of the year. Current predictions show inflation rising 5.4% overall this year, with a 4.5% core inflation rate, excluding food and energy. It is expected to drop to a 2.8% to 3.1% core rate in 2023, then continue to drop to a 2.3% rate in 2024, and then finally to the 2% target rate in 2025.

Powell also noted the challenges the Fed will face in executing a soft landing for the economy, telling reporters, “If we want to set ourselves up, really light the way to another period of a very strong labor market, we have got to get inflation behind us. I wish there was a painless way to do that. There isn’t. What we need to do is get rates up to the point where we’re putting meaningful downward pressure on inflation. And that’s what we’re doing.”

Going forward Powell said decisions on policy will be made on a meeting by meeting basis, noting that at some point the rate of interest rate hikes would have to slow.

Due to the persistent nature of the inflationary pressures, it is now expected that the Fed will need to raise rates higher, and maintain them there longer than had previously been expected. Current predictions are for the fed funds rate to rise to 4.4% by the end of the year, and 4.6% by the end of 2023. Previously it had been expected that the rate would rise to 3.4% this year, and 3.8% by the end of next year.

Photo of Jerome Powell courtesy of Wikipedia