As more investment money comes out of Washington DC, the race to dominate the electric vehicle industry is heating up. However as it does, the assembly workers who are the heart of the auto industry are increasingly fearing the revolution is going to leave them behind.

Keith Cooley, former head of Michigan’s Labor Department, said in an interview, “When we look carefully at what goes on on the factory floor, it won’t be less workers. There will be different people building the cars.“

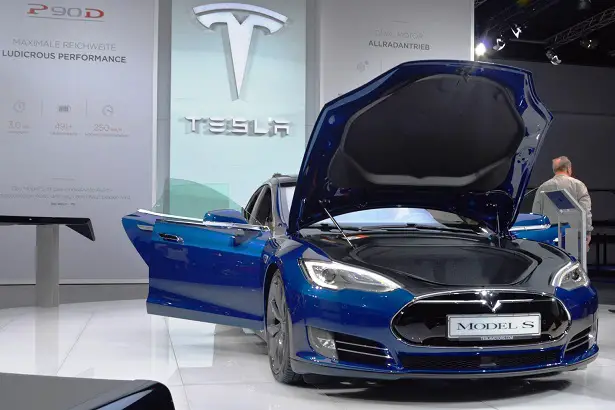

Analysts are beginning to say that the new factory jobs associated with electric vehicles will require a higher level of education and despite what Keith Cooley says, there will be fewer of them in the future. Currently, electric vehicles are requiring 30% less manufacturing labor than conventional internal combustion engine vehicles. This is mainly due to the number of complex systems required to support an internal combustion engine’s operation. From cooling systems, to oil and lubrication systems, to fuel-delivery systems, to electrical generation systems, to complex transmissions, these are all systems which are not present in an electric vehicle, where electricity from a battery is merely delivered to motors at the wheels in amounts determined by a computer.

This means newer electric vehicles don’t require the manual assembly of all those additional systems during the manufacture process. It also means the more complex electrical and computer systems will require a different type of worker to handle the assembly.

Cooley noted, “The lines that run to drive oil or gas around an internal combustion engine aren’t going to be there.”

This change will also hit parts suppliers in the industry, many of whom are situated near manufacturing centers near midwestern cities like Kokomo, Indiana; Lima, Ohio; and Detroit, Michigan. Increasingly now automakers are taking the manufacture and supply of their parts in house, in part due to fierce competition for valuable and rarer resources such as rare-earth metals, and the experiences they had with the disordered supply chains of the pandemic era.

Sanya Carley, an Indiana University professor and contributor to the Industrial Heartland study noted in an interview, “Car companies in some of these places actually make up a decent proportion of the tax revenue, and they employ many people within the surrounding community. So the fate of these companies is very intimately tied to the fate of the communities.“

Analysts say that it is hoped two recent pieces of legislation may help ease the transition to the newer forms of manufacturing, namely the Inflation Reduction Act, and the CHIPS Act, both of which provide billions in incentives to businesses which pursue clean energy technology. However while those bills will greatly aid car manufacturers in transitioning their businesses from older combustion vehicles to electric vehicles, it is unclear what assistance they will provide to the workers and small businesses which underlie combustion engine car manufacturing, and who will not be as suited to the new forms of manufacturing and business models.

However there is a chance the changeover to EVs may not happen as expected. As automakers enthusiastically jump into the electric car market and shift production lines over to producing EV’s they are left wondering how quickly demand will begin to materialize. In 2021, just 9% of global auto sales were electric vehicles.

If demand does not materialize sufficiently, and it might not due to issues with EVs ranging from battery range, to cold weather operation, to issues with charging in areas with electrical grid problems, or a lack of chargers, then the issue of the changeover could become moot.