As single-family homebuilding declined in June, US construction spending fell dramatically, in the first signs of the effects of the Federal Reserve’s interest rate hikes and the slowing economy.

Construction spending declined 1.1% in June, according to Commerce Department data. According to estimates by economists, it was predicted to rise 0.1%. It had risen by 0.1% in May.

On a year over year basis, construction spending rose 8.3% in June, while private construction projects saw spending decrease 1.3% following a 0.2% increase in May. That was the steepest quarterly decline in two years.

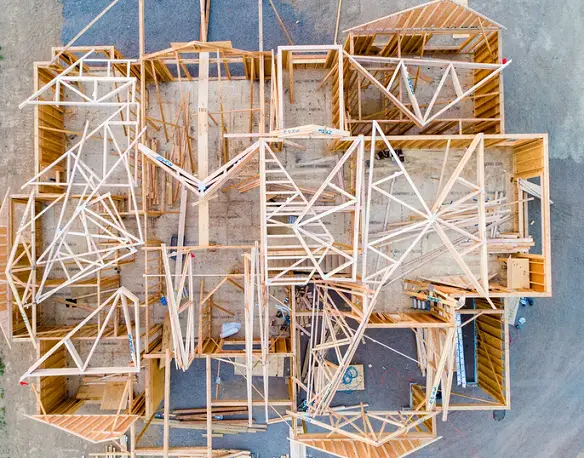

Residential construction investment fell 1.6%, as single family projects saw spending decline 3.1%. Multi-family housing projects outlays were up 0.4%.

Private non-residential structure investments, like gas and oil well drilling fell 0.5% in June. That is the fifth straight quarter of declines for non-residential structures.

Public construction project spending fell 0.5% following a 0.7% decline in May. State and local government construction project investment dropped 0.6%, while federal government projects increased 1.2%.

This follows on a slew of concerning economic data. Gross Domestic Product is declined at an annualized rate of 0.9% in the last quarter, following on a 1.6% decline in Q1. Meanwhile in the last policy meeting the Federal Reserve raised rates another 75 basis points, for a combined 225 basis point hike since March.

As that causes concerns for a slowing economy and increased unemployment due to the monetary tightening, it also raises mortgage rates, making it less affordable to buy a home, decreasing demand even further. Meaning construction declines will likely continue for some time to come.