On Tuesday, Paul Pelosi, husband of US House Speaker Nancy Pelosi, sold off his shares of the chipmaker Nvidia. He made the sale just days before the House is set to consider legislation which would gift the tech sector with subsidies and tax credits worth over $70 billion, as the US government looks to bring chipmaking and high tech manufacture home to the US.

The trade was noted in a periodic transaction report filed by Speaker Pelosi. The report showed that Paul Pelosi divested 25,000 shares of Nvidia for about $4.1 million, at a loss of $341,365.

There had been some controversy, as transaction reports had shown that Paul Pelosi had bought 5,000 shares of Nvidia in July of 2021, and that he then exercised options to buy 20,000 more shares in June, as debate over the legislation was growing.

Although Nvidia designs its own chips, it uses other companies to manufacture them, so it is not clear to what extent the subsidies of the bill will bleed back to Nvidia’s bottom line. It is possible were the bill to pass, investors would exit Nvidia on finding the bill would not profit the company.

Nvidia was expected to see benefits from the CHIPS Act, or the Creating Helpful Incentives to Produce Semiconductors for America Act. The bill is expected to come up for a vote on final passage in the Senate imminently. The legislation will provide about $52 billion in government subsidies for US semiconductor manufacture, as well as investment tax credits for chip manufacturing plants worth $24 billion.

After passage in the Senate, it is expected the bill will be taken up by the House, where as speaker, Representative Nancy Pelosi will oversee its passage.

Nancy Pelosi has previously defended the right of lawmakers to trade in stocks, however she later signaled a willingness to potentially advance legislation which would restrict trading by lawmakers.

A 2012 law already makes it illegal for lawmakers to profit personally from information gleaned in the course of their duties as lawmakers in Congress. The law requires they file reports on any stock transaction by themselves or family members within 45 days of the transactions.

Unusual Whales, a service selling financial data, released a report last year which found lawmakers in congress traded roughly $290 million in stocks, options, cryptocurrency, and other assets, while routinely outperforming the market.

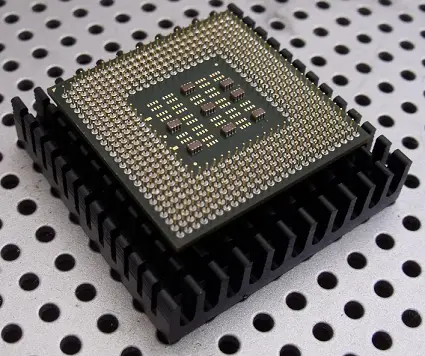

In 2020, Nvidia overtook Intel, seizing the title of the most valuable US-based chipmaker.