Twitter investors have filed suit against Elon Musk for allegedly manipulating stock prices before launching his $44 billion dollar takeover bid. The suit claims Musk saved money by not disclosing he had bought more than a 5% position in twitter by March 14th, a technical violation of SEC rules. The suit claims Musk only revealed his position in April, when he revealed he held a 9.2 percent stake in the company.

The suit also criticizes Musk’s statements after his announcement, especially his claims that Twitter might have fewer real users and more bots than the company had previously disclosed, and that this might pose a major problem for the deal.

The investors are seeking class-action status, and have not specified what damages they are seeking. Both Twitter and Musk have declined to comment on the suit.

Musk has been sued twice previously over his Twitter bid, once in a similar case as this, and once by a Florida pension fund which claimed his takeover would violate a Delaware law that would bar any merger until 2025.

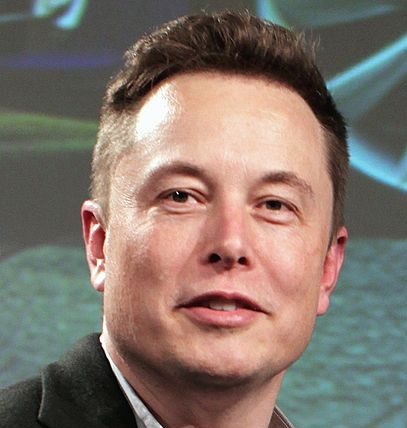

Photo of Elon Musk Courtesy of Wikipedia