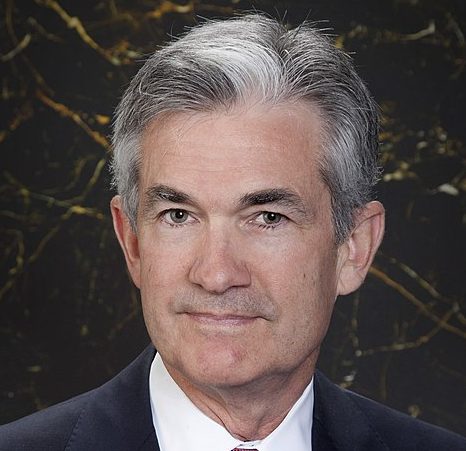

For months, Fed Chief Jerome Powell has assured everyone that policy makers were in full control, and there was no recession on the horizon. In mid march the Fed struck a reassuring tone, looking at a jobless rate at a half-century low of 3.5%, and inflation gradually descending to 2%.

But now Powell is striking a different tone, warning investors, “There could be some pain involved in restoring price stability,” and that unemployment may “move up a few ticks.” Although he also mentions plausible pathways to a “softish” landing, it is a change in tone that has not gone unnoticed.

The Fed’s policy has turned aggressive as well, reversing pandemic purchases by $95 billion per month as it has begun hiking interest rates by a half a point per meeting. Mortgage rates have jumped 2% to five percent, and still Powell is signaling they may have to do more.

The longer the Fed hikes rates to cool the economy, the worse any ultimate recession is likely to be.

Ryan Sweet, economic research director at Moody’s Analytics, summed up the Fed’s unenviable position when he wrote, “The Fed could be faced with a Hobson’s choice: Push the economy into a mild recession” to tame inflation, “or wait and possibly cause a more significant recession.”

In the face of this choice, Powell may be trying to convince businesses and investors to become more cautious now and prepare for pain, in the hopes of avoiding a much larger recession later. This may mean investors should not expect the Fed to intervene to help rally any falling stock prices.

Others on Wall Street have picked up on, and are mirroring the Fed Chief’s tone. Wells Fargo CEO Charlie Scharf said there’s “no question” the economy will turn cooler. Jefferies chief market strategist David Zervos has written that policy officials “might be secretly cheering” the stock market drop, “hoping these flames will do just enough demand-side economic damage to solve their supply-side inflation woes.” Fed President Neel Kashkari, among the more dovish, said, “We are doing everything we can to achieve a soft landing, but I’ll be honest with you: I don’t know the odds of us pulling that off.”

Although retailer stocks like Walmart and Target have dropped, gas prices have surged in the face of the Ukraine conflict, and households have lost about 5.5 trillion in wealth this year, Jefferies Chief Financial Economist Aneta Markowska wrote that the combination of strong wage growth, elevated savings and ample borrowing capacity are likely “to sustain above-trend consumption growth this year, even in the face of high inflation.” She went on to note, consumer spending is likely “to remain healthy until the labor market begins to crack.” That would seem a distant proposition at present, as Labor Department data shows 11.5 million job openings vs. 5.9 million unemployed.

This would seem to be supported by retailers who still report strong sales, amid inventory issues and supply chain woes.